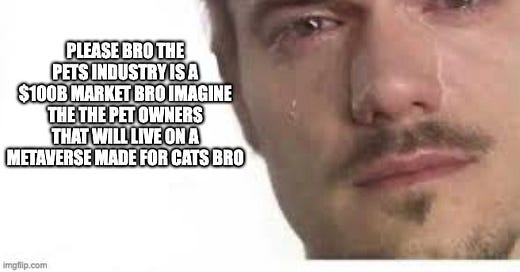

“What problem are you solving by building this Metaverse for cats?”

“Well, today cats don’t have a Metaverse to hang out in. With Cataverse, they will!”

The above probably captures 75% of the conversations my team at Spartan has had with over 300 projects in crypto last year.

Many new founders in crypto don’t seem to give much thought to the specific people who will be using their products.

I don’t blame them.

When you’re laying the piping for a building, you don’t really think about whether the fifth floor will be turned into SBF’s personal ping pong room or Gordon Ramsay’s Michelin-star joint.

In crypto’s early days, the low-hanging fruits were up for grabs. Ethereum didn’t need to think about every specific use case - it just needed to work. Uniswap and Aave didn’t need to predict the growth of DeFi, stablecoins, interest-bearing tokens etc. to know that trading and borrowing were foundational use cases. Opensea didn’t need to predict P2E game assets to win.

“The most exciting applications on Ethereum are probably ones we haven’t even thought of” - Vitalik Buterin, 2014

But as competition saturates and developers go further up the stack, founders need to start thinking more critically about solving specific pain points.

"If I build a great product, they will come" and Other Damned Lies

Years ago I was in a meeting with a team building a new protocol. The founders had long, stellar careers at the top of the food chain in the industry they hailed from, and even courted a few well known VCs to back their all-star team.

In our first meeting, one of the founders opened the table for inquiry.

I asked what in my mind was an innocuous question.

"So who will be your first users and have you spoken to them?"

The founder responded with a 10-minute tirade on how bone-headed a question it was, that my lack of experience meant I had no clue about his industry, how people in crypto are mostly young and ignorant, and that his experience told him there were billions - no, trillions! - waiting to use this protocol, just you wait!

The project never took off.

Despite my little moment of vindication, he was right!

Many young crypto hackers are characterized by a solipsistic worldview in their product scope. Because degens have an intuitive sense of what other degens need, “build it and they’ll come” has worked thus far without much need for a wider awareness of “real world” use cases.

Once we begin to wade into the mainstream and build for people outside of the milieu of our anon frogs and cats on Twitter, this will not fly. But the contrary - building a crypto version of a product just because it has product-market fit in the non-crypto world - also won’t work (more below).

While I don't doubt that we will see institutions deploying directly into products with DeFi backends, we are a long way from when your Blackstone fund manager can sleep well knowing half their clients' capital is in a smart contract managed by an anime schoolgirl.

For a founder, being early is as good as being wrong.

Skeumorphic Deez Nuts

In 2017, VCs were salivating over "Amazon, but decentralized" and "Uber, but on the blockchain". Some of them are still doing this in 2022, bless their hearts.

Midway into DeFi summer in 2020, we saw a ton of projects building "Venmo, but decentralized", or "your savings account, but on DeFi" in the form of a bazillion yield aggregators.

In 2022, every indie game developer wants a piece of the Metaverse pie. Expect "League of Legends, but characters are NFTs" and "Fortnite, but vBucks are tokens" soon.

While most savvy founders are right to avoid “build it and they’ll come” thinking, the correct response is almost never “if it worked in Web 2, it will work in Web 3”. Copying mainstream consumer products may seem like a safe bet as the markets have been validated, but skeumorphism is not a go-to-market strategy.

Being decentralized / having a token does not absolve you from the requirements beset upon scaling a product people actually want to use.

In fact, the considerable frictions of using a crypto backend means it’s likely harder, as you must make up for the UX shortfall by delivering a product that’s 10x better than its centralized counterparts.

While your friends may occasionally react to a Huff Post article about Big Tech encroaching on personal privacy with an angry emoji, most users are compelled by convenience, not privacy.

If you want your users to back up their seed phrase to use your "users own their data" version of Uber, you better make sure you’re offering more than just "mUh deCentRaliZation".

While there are notable exceptions (e.g. USD-denominated stablecoins) in reality, skeumorphism is lazy thinking.

Ideology doesn't sell

While preserving decentralization is one of the main reasons we’re in this wacko industry to begin with, founders must remember that ideology is rarely a pain point.

It's easier to convince people to use a product because it solves a problem they already have, rather than try to fundamentally alter their worldview by shoving The Sovereign Individual down their throats.

For all the hate that BitClout/DeSo's tone-deaf launch received, the founder had a point with this:

This doesn't mean founders in crypto should de-prioritize decentralization, but it helps to be clearer on what is top-of-mind for 80% of your users if your intention is to scale beyond a handful of cypherpunk NEETs.

And what’s top of mind for most users is probably more in line with "which filter makes my skin look better" than "how can I be sure nation states will not violate my right to personal privacy on this fine afternoon".

Sometimes this is as simple as positioning: for business owners, the threat of having their entire storefront be de-platformed by a Web 2 incumbent speaks volumes more than "DOWN WITH WEB 2, USERS DESERVE TO OWN THEIR DATA".

Refine your product positioning, sell solutions, not ideology.

What Would Elon Do?

Many young founders are enthralled by the Muskian and Zuckerberg-ian fables of entrepreneurship.

"Wouldn't it be dope to fly humans to Mars?" and "wouldn't it be sick to move our entire social experience online?" gave birth to $100-$600 billion dollar bonanzas, but likely do not reflect how the majority of successful startups begin.

Most successful ventures begin by having a specific pain point in mind.

Often times these pain points are based in a founder's personal insight from years of in-industry experience. If you are a young founder and don't have that, then you'll need to rigorously validate your assumptions about a market to make up for the shortfall.

Before putting together your pitch deck to raise at $100M pre-money + pre-product for the 30th self-rebasing totally-not-a-ponzi pseudo-dollar, block out a weekend to reach out to 100 potential users. Interview all of them. Don’t try to convince them to use your product; instead, listen to what they want to use.

Many first-time founders don't have a first-principles framework around this and resort to reason by analogy - i.e. by forking protocols that have achieved product market fit.

"(INSERT ETHEREUM PROTOCOL) has users? Let's fork this onto (INSERT ALTERNATIVE L1) and add some features to make it seem like we came up with this"

I can name with 1 hand how many times this has ended in home run successes. To avoid this as a founder in crypto, you ought to be able to answer the following 3 questions quickly.

If not, consider going back to the drawing board until you can:

Who are the first 100 people dying to use your product TODAY?

Have you spoken to these 100 people?

If not, do you have a good reason not to?

If you’re a “DeFi for institutions” product, which institution have you spoken to besides your junior investment banker friend? What are the conditions for institutions to entrust your protocol with 1%+ of their capital under management?

If you’re a NFT borrowing product, how many guilds, scholars, and collectors have you spoken to? How much volume will they generate on your protocol if it were live today?

If you’re a new layer 1, how many developers have indicated interest in building on your chain without external incentives?

Improve your odds

As the mania of a Fed-fueled pig-on-LSD market subsides, we'll start to remember that token price is a marketing tool and not proxy for success.

We'll realize that maybe not everyone who flipped a few JPEG successfully are the next Marc Andreessen.

We’ll remember that building tokens that pump in price are easy, but building products that people actually give a shit about is just as hard, if not harder than Web 2.

Sure, it's easy for me to sit here and opine on what others should/ should not build; the founders are the ones who do the hard work. But that's also why founders that successfully got product market fit and scaled are billionaires now and I'm writing this blog while eating Cheetos in my underwear.

Building products in Web 3 is not meant to be easier.

It will get even harder.

But if you want to improve your odds, maybe I can help.

Reach out, tell me what you're solving: @mrjasonchoi

(If it's a Metaverse for cats, re-read this piece. Dogs maybe ok.)

If you enjoyed this post:

Appreciate your insights Jason!

try this one on for size https://www.CosellerProtocol.com

would definitely be interested in chatting